Have you ever received a bill titled APLUC and wondered what exactly it means? APLUC, short for the Anambra Property and Land Use Charge, is a land-based tax introduced in 2011 to bring order to property taxation in the State. But many landowners and occupiers are unaware of what it covers, who pays, or the consequences of ignoring it.

This article simplifies the Property and Land Use Charge in Anambra State, referencing the actual law so you can understand your rights and obligations.

What is APLUC (Anambra Property and Land Use Charge)?

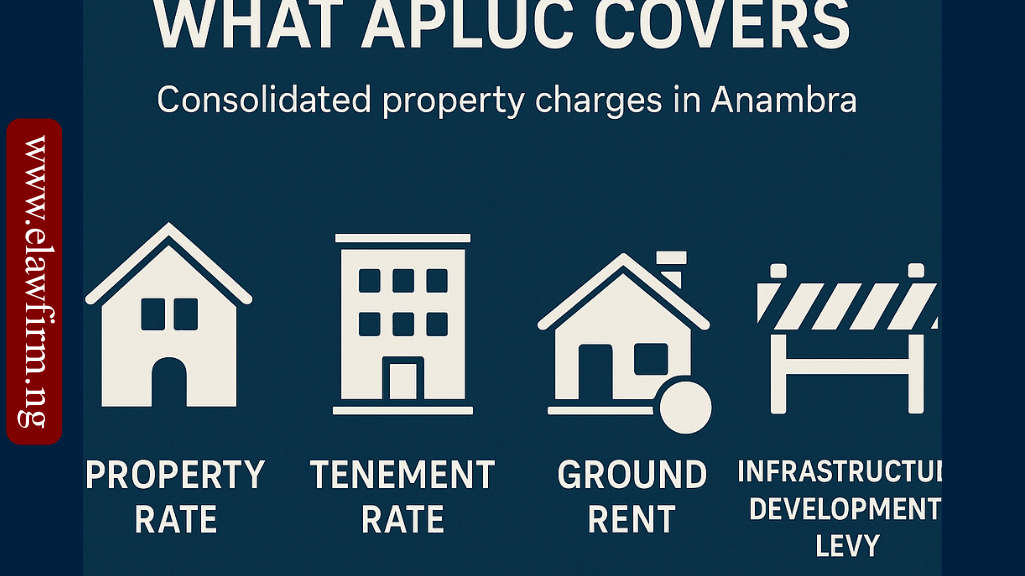

APLUC was created by the Property and Land Use Charge Law, 2011, to consolidate several existing charges into one unified payment.1 These include:

- Property Rate

- Tenement Rate

- Ground Rent

- Infrastructure Development Levy

The goal is to streamline collection and increase the State’s internally generated revenue.

- What is APLUC (Anambra Property and Land Use Charge)?

- Who Is Liable to Pay APLUC?

- What Properties Are Exempt from APLUC?

- How Is APLUC Calculated?

- How and When Should You Pay Property and Land Use Charge in Anambra State?

- What Happens If You Do Not Pay APLUC?

- Can You Challenge a Property and Land Use Charge in Anambra State Assessment?

- FAQs on Property and Land Use Charge in Anambra State

- Need Help Understanding Property and Land Use Charge in Anambra State?

Who Is Liable to Pay APLUC?

The owner of any chargeable property is responsible for paying APLUC2

An “owner” includes:

- The person receiving rent

- Trustees, agents, or leaseholders

- Those directly allocated land by the State3

In some cases, the collecting authority or its delegate may by notice in writing appoint any person including an occupier of a chargable property as agent of the owner and required to pay the land use charge from funds they hold on behalf of the owner4

What Properties Are Exempt from APLUC?

Land use charge is not payable on all properties. The law exempts certain classes of property, such as5

- Property owned and occupied by religious body and used exclusively for public worship or religious education used exclusively for public worship or religious education

- Cemeteries and burial grounds (excluding private profit-making ones)

- Registered and recognised health or other institution or educational institution certified by commissioner to be non-profit making

- Property used as public libraries

- Palaces of recognised traditional rulers

- Any other exemption granted by the Governor via Gazette

However, if a property’s use changes, or the new occupant is not eligible, such previously exempted property becomes chargable becomes chargeable again6.

How Is APLUC Calculated?

The Commissioner for Finance is empowered to determine the formula for calculating APLUC annually and publish it7.

To achieve professional and fair assessments, the Commissioner may appoint valuers or consultants to inspect properties between the hours of 7.00am and 5.00pm8

Assessors are authorised to

a. Enter, inspect, survey and assess the property

b. Request documents or other information to be produced to the identification officer or assessor

c. Take photographs

d. Make copies of documents necessary for the inspection

How and When Should You Pay Property and Land Use Charge in Anambra State?

Once your property is assessed, you will receive a Property and Land Use Charge Demand Notice.9 The notice shall be delivered to the owner or occupier of the property. However, if the owner, occupier or agent is not available to take delivery of the notice, it will be posted on the property and such posting shall be deemed as sufficient delivery of the notice.

Payment of property and land use charge shall be made at any bank specified in the land use charge demand notice.10

Also, upon application in writing made by the owner, the commissioner may reduce the land use charge to such amount the commissioner deems fit, if the owner pays within 15 days of receiving the demand notice11.

What Happens If You Do Not Pay APLUC?

Failing or delaying to pay within the time specified in the notice has serious consequences:

- 2.5% monthly interest for the first 3 months after the period specifcified in the notice.

- Receivership: if payment is not made after the expiration of the three months, the State or its agent may take over the property until full payment is made. However, the owner can apply for the release of the property upon payment of outstanding charge.12

Can You Challenge a Property and Land Use Charge in Anambra State Assessment?

Yes, you can file an appeal within 30 days of receiving the demand notice to the Asssessment Appeal Tribunal,13 If you are aggrieved by the decision that a property you owned is a chargeable property or by the amount you are liable to pay as land use charge. The burden of proving an excessive assessment of property is on the owner who is challenging the assessment. The tribunal at the end of the proceedings shall make decision as it deems fit.

FAQs on Property and Land Use Charge in Anambra State

What does APLUC mean?

APLUC is acronmy for Anambra Property and Land Use Charge, a unified tax created under the Property and Land Use Charge of Anambra State 2011

Can tenants be liable?

Owners are primarily liable, but tenants may be directed to pay if declared agents by a notice in writing by the collecting authority or its agent under Section 12

Need Help Understanding Property and Land Use Charge in Anambra State?

Do not let confusion, delay, or fear of government agencies put your property at risk. Consult with a property lawyer of your choice.

For further inquiry Book a legal consultation or send a WhatApp message to +2349045532566.

Disclaimer

This article is for general information purposes only. It does not constitute legal advice. For case-specific help, please consult a qualified legal practitioner.

FOOTNOTES

- Section 3(2) Property and Land Use Charge Law of Anambra State 2011 ↩︎

- Section 6 Property and Land Use Charge Law of Anambra State 2011 ↩︎

- Section 2 Property and Land Use Charge Law of Anambra State 2011 ↩︎

- Section 12 of the Property and Land Use Charge Law of Anambra State 2011 ↩︎

- Section 9 of the Property and Land Use Charge Law of Anambra State 2011 ↩︎

- Section 10(1) of the Property and Land Use Charge Law of Anambra State 2011 ↩︎

- Section 7(1) of the Property and Land Use Charge Law of Anambra State 2011 ↩︎

- Section 5(3) of the Property and Land Use Charge Law of Anambra State 2011 ↩︎

- Section 11(1) of the Property and Land Use Charge Law of Anambra State 2011 ↩︎

- Section 8 of the Property and Land Use Charge Law of Anambra State 2011 ↩︎

- Section 11(5) of the Property and Land Use Charge Law of Anambra State 2011 ↩︎

- Section 22 of the Property and Land Use Charge Law of Anambra State 2011 ↩︎

- Section 16(2) of the Property and Land Use Charge Law of Anambra State 2011 ↩︎